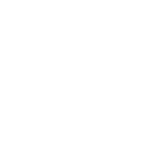

- In 2023, the Indiana General Assembly slipped an economicenhancement district (EED) into the state budget, which is a special taxing district impacting the mile square in downtown Indianapolis.

- The EED is managed and staffed by Downtown Indy, Inc – in other words the EED provides additional operating funds for Downtown Indy, Inc.

- The law contains no limitations on the additional taxes that will be levied.

What does this mean for property owners, businesses and residents in the mile square?

This new tax rate is .1681% of assessed value for commercial properties and apartments, meaning a building with assessed value of $50M will be taxed $84,050 and a $100M building will be taxed $168,100. Residential properties will pay a flat $250 fee.

If this tax goes into effect, it will cost apartment renters an additional $30 - 60 per month, or $360 - 720 per yer. Commercial office space will increase $.15 - .22 per square foot, meaning a 10,000 square foot business will pay $1,500 - 2,200 more per year.

The Economic Enhancement District has no guardrails. There are no limits on annual increases to the additional taxes that will be requested by the city.

With previous tax districts, property owners being taxed had the ability to approve or reject the petition brought forth by the city, which had the effect of limiting the amount of tax that could be assessed. It forced the City to present a need for the services proposed to property owners. This forced accountability on Downtown Indy and the City, as property owners in the district had a vote. However, under the Economic Enhancement District, property owners have been excluded from the approval process, giving the City and Downtown Indy unprecedented authority to tax property owners and spend taxpayer dollars for whatever projects it wishes for downtown.

With previous tax districts, property owners being taxed had the ability to approve or reject the petition brought forth by the city, which had the effect of limiting the amount of tax that could be assessed. It forced the City to present a need for the services proposed to property owners. This forced accountability on Downtown Indy and the City, as property owners in the district had a vote. However, under the Economic Enhancement District, property owners have been excluded from the approval process, giving the City and Downtown Indy unprecedented authority to tax property owners and spend taxpayer dollars for whatever projects it wishes for downtown.Show Me the Money!

The Tax dollars from the EDD allows Downtown Indy Inc. to fund the following projects.

- pay for security in public areas;

- install security cameras and link them to the system;

- employ safety ambassadors;

- clean and maintain sidewalks;

- landscape or beautify public areas;

- activate and promote events;

- create innovative approaches to attracting new businesses;

- support business development;

- plan improvement activities;

- conduct extensive outreach to homeless; and fund facility operations for a low barrier “no rules” shelter for homeless individuals;

YOUR TAX DOLLARS ALREADY FUND THE MAJORITY OF THESE SERVICES, WHILE THE REST ARE SUPPLEMENTED BY PHILANTHROPIC DONATIONS

What is a Low-Barrier “No Rules” Homeless Shelter?

A no rules homeless shelter would have minimal restrictions for people wishing to enter the space to encourage its use (i.e. don’t have to be sober, no ID’s required, etc.). The shelter would also offer supportive services on a voluntary basis for those in the shelter.

In theory, the no rules shelter can help keep our homeless neighbors off the street during the evening hours or in times of bad weather, but it is unclear whether a no rules shelter will include programming to keep homeless neighbors off the streets during business hours.